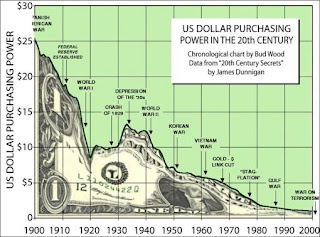

At the level of monetary stimulus in the USA, the 2008 crisis is getting smaller when one compares not only the magnitude of the stimuli currently implemented by the Federal Reserve due to the pandemic, but the speed with which said monetary issue has been injected into the system. And the United States is not alone in this, and this peculiarity has enormous consequences for exchange rate levels.

The main central banks of the world such as the BOJ of Japan, the ECB of Europe, Canada, Australia, New Zealand, to name a few, have been implementing monetary intervention rounds never seen before and when I say this I include the period 2008/2014 where the Until now, interventions were considered historical due to their magnitude. If we focus specifically on the USA, this time it shows something different from 2008/2009, when the Federal Reserve implements Quantitative Easing for the first time (understood as the process by which the Fed issues dollars against the purchase of financial assets).

Today, the dollar is not collapsing versus the Euro and the Yen as it was then. The reason is simple: today the big three, USA, Europe and Japan, are issuing at the same time simultaneously, so that the three pairs of coins are in a relatively stable environment, neither can fight against the other because they are all being mega emitted at once. However, in 2008/2009, while the Federal Reserve announced QEI, the Euro Zone was left without doing anything relevant, which caused a great rally of the euro against the dollar that led it to trade above 1.50 during 2009. Conclusion 1: the The dollar is not devaluing against any currency because they are all mega-issuing at the same time.

However, this does not mean that the entire world has not been cutting the dollar since this whole virus issue began. This time, the world instead of shortening the dollar against the Euro, the Yen or the Australian dollar to name a few, has already begun to reflate against other non-currency financial assets. Let us remember that by reflation is meant the process of inflation of financial assets motivated by intervention of central banks via issuance. Given that today the coronavirus pandemic generated a literal flood of fiat money (paper currency), said liquidity has been filtering through the system against real money (assets of intrinsic value), maintaining their respective price level that would otherwise have collapsed. unthinkable levels.

As in 2008, the Central Bank Free Put understood as an implicit insurance that through issuance secures a floor at the asset price, is activated again and again generates a market that ignores fundamentals and is simply dedicated to protecting itself against devaluation of the dollar versus anything that has its own value like shares, gold, to name a few. Conclusion 2: two months ago, the dollar began to devalue this time, not against currencies, but against another group of assets, as also happened in the 2008/2010 crisis.

As an Amazon Associate I earn from qualifying purchases.

Now, let's look at who the winners were back then. If we analyze the accumulated returns since the S&P lowered in March 2009, the following performances occurred. Since March 2009, the QQQ (ETF that replicates US technology) is 757% positive, that is, the dollar devalued against the Nasdaq by 757%. The SPY (ETF that replicates S&P) is 323%, that is, a devaluation of the dollar against the S&P of 323% and the DIA (ETF that replicates the Dow Jones) is 265%. For emerging team, however, things did not go so well. The EEM (ETF that replicates Emerging Diversity Equity) is only 75% positive. Gold is 73% positive from S&P lows in 2009.

The EWG (ETF that replicates equity from Germany) is 83% positive. Australia's EWA is 57% higher, Italy's EWI is only 3% positive and China's FXI 62%. Continuing with the comparison and going to commodities, oil is 47% negative since 2009, soybean 3% negative, corn 8% negative, copper 43% positive. Conclusion 3: The big winner of the 2008/2014 reflation was the North American stock market. For the most part, the dollars issued by the Federal Reserve were reflating all in the USA, devaluing against their own equity.

The million dollar question: why this time should be different? So far this year, the QQQ is already positive at + 5.76%. The XLK, ETF that replicates information technology, is + 3.39% YTD. Other sectors such as airlines (JETS) is -56% in the year. Energy (XLE) is -35%. Spreading (PEJ) is -40%. Financial sector (XLF) is -27%. However, almost all of these sectors, with the exception of JETS, have been recovering strongly since March 23, the date on which the SPY made minimums. Obviously, nothing is defined in this crazy market generated by the pandemic. The S&P may go looking for new lows or the bulls may continue to ignore the real effects waiting for a quick economic rebound. As of Friday, the SPY closed exactly at 61.8% of Fibonacci in a very bullish and very challenging sign and with a VIX sub 30.

Everything is possible in the next 6 months, both up and down, but if one forgets the short-term noise that will surely come, in two years time it would seem that a lot of the US equity sector is cheap to start accumulating sequentially and with a goal of 2022. Conclusion 4: shortening the Free Put of the Federal Reserve was never a profitable decision and I don't think that this time be the exception. The mega devaluation of the dollar will not be against currencies but mainly against North American equity.

Comments

Post a Comment